How to Record VAT Remittance.

updated 3 months ago

Value Added Tax is a compulsory levy on the consumption of goods and services sold in Nigeria. Here is how to record VAT remittance on Simplebks.

Recording VAT Remittance on Simplebks: A Step-by-Step Guide

Step 1: Log in to your Simplebks account at www.simplebks.com.

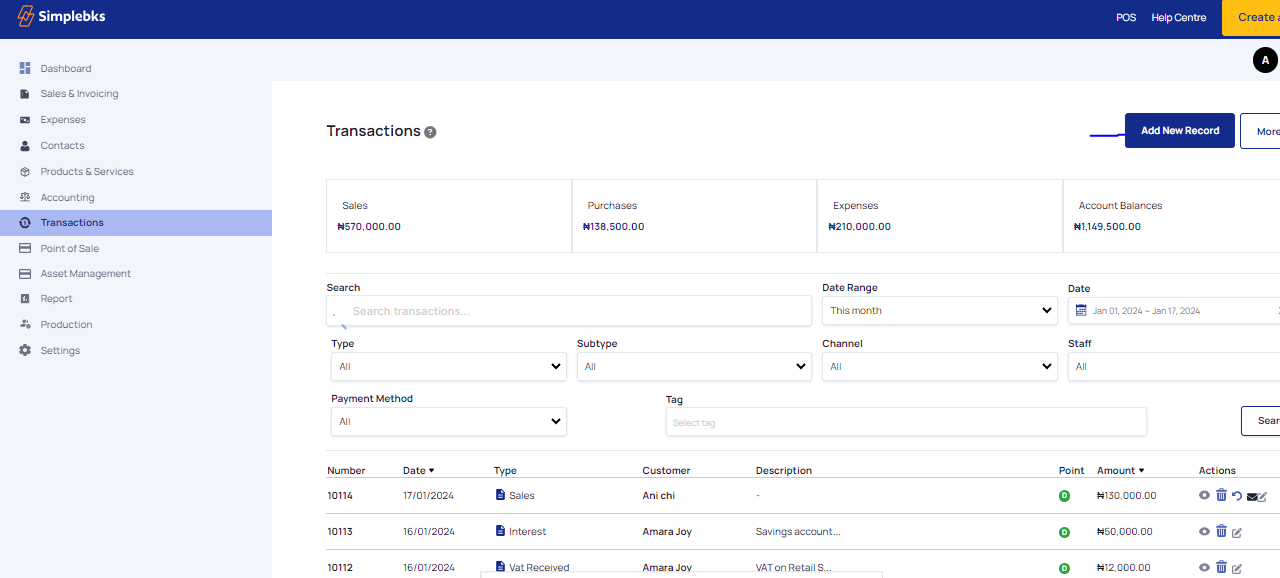

Step 2: Access the "Transactions" section on the sidebar and select "Add New Record."

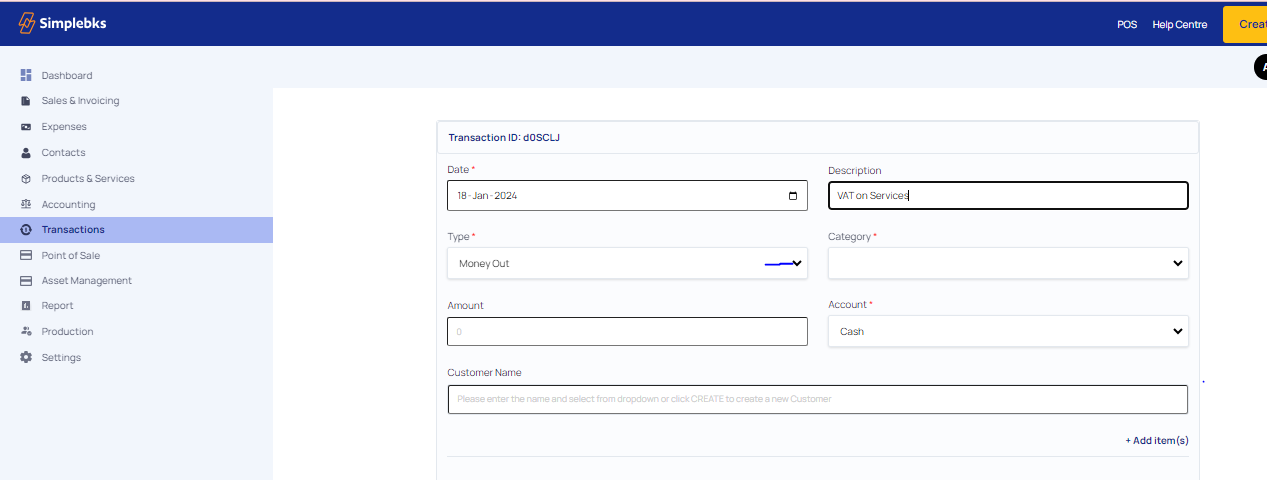

Step 3: Fill in the necessary details:

Transaction Date: Input the date of the VAT remittance.

Description: Provide a brief description of the remittance transaction.

Step 4: Specify transaction details:

Transaction Type: Choose "Money Out" to indicate funds going out.

Category: Select "VAT Remittance" to categorize the transaction appropriately.

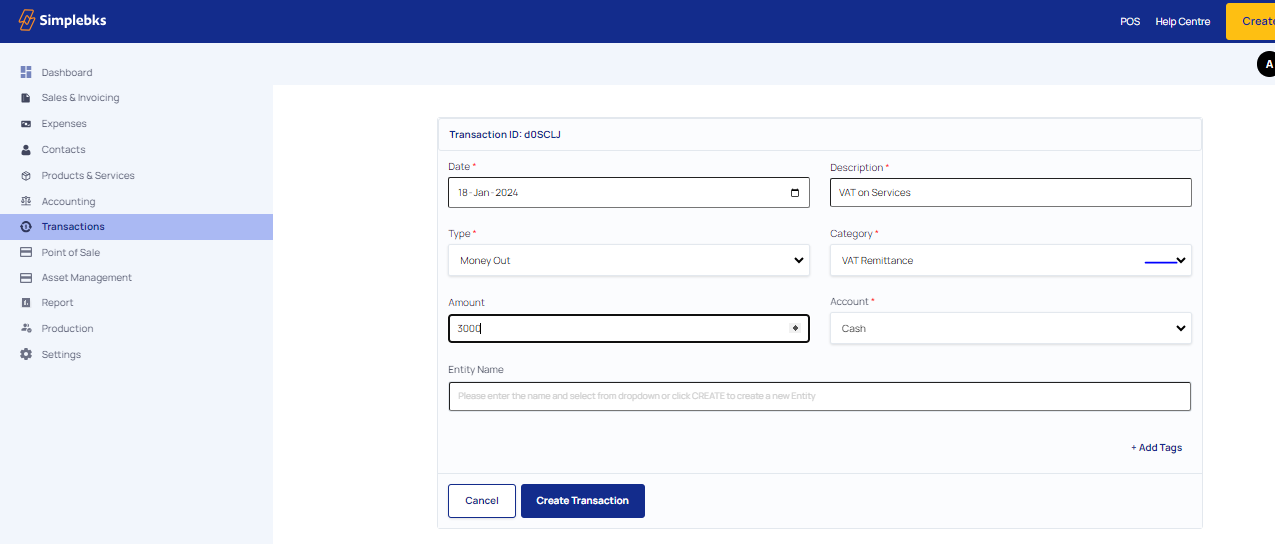

Step 5: Identify the details of the remittance:

Enter the Amount: Specify the total amount being remitted.

Account: Indicate whether the remittance is made in cash or through a bank (mention the specific bank).

Step 6: Additional information:

Enter the Entity Name: Specify the name associated with the VAT remittance.

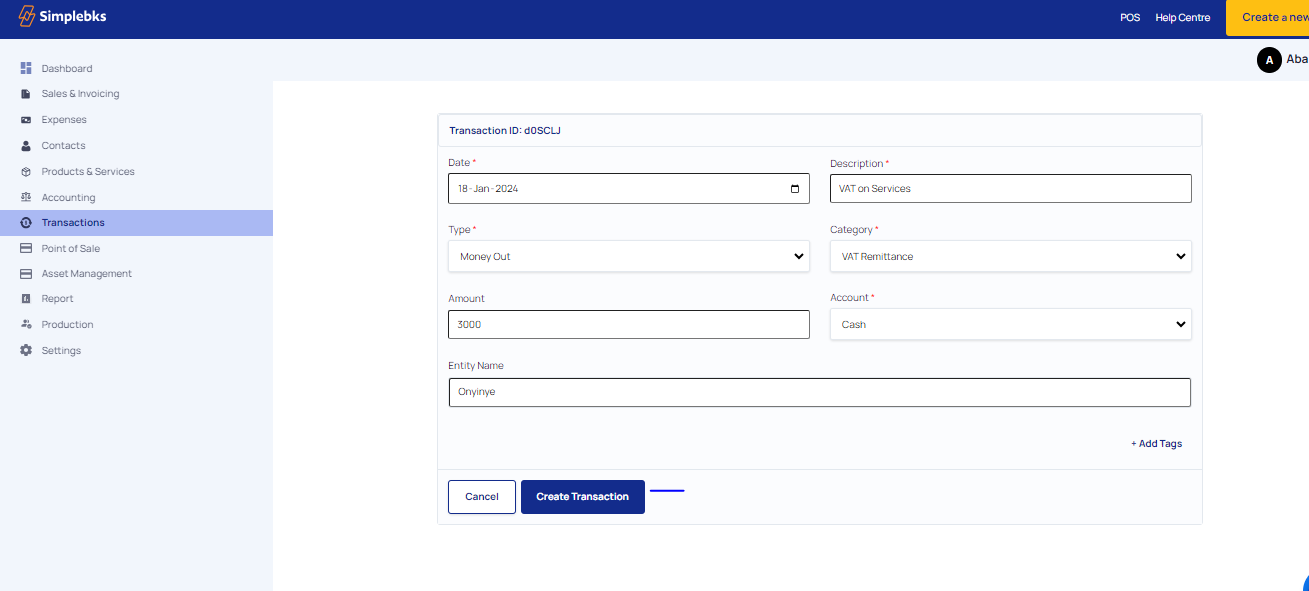

Step 7: Confirm the transaction:

Click on "Create Transaction" to finalize the entry.

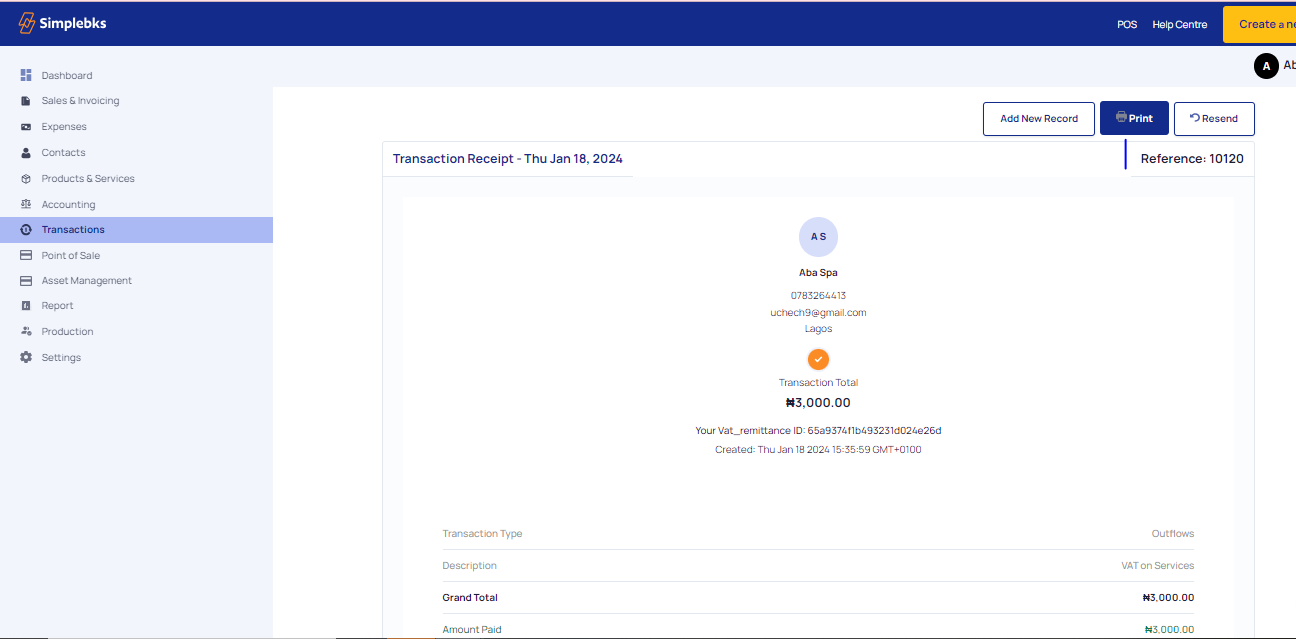

Step 8: Transaction success:

Receive confirmation that the VAT remittance transaction has been created successfully.

Step 9: Document the transaction:

Click on "Print" to obtain a physical copy or download the receipt as a PDF.

Was this article helpful?