How to Record Gifts Received.

updated 3 months ago

How to Record Gift Received

A gift is an offering of money or assets made by one person to another in which nothing of comparable value is given, or expected to be given, in return. Some gifts are tax-free for both the donor and the recipient, but certain gifts may warrant the payment of taxes.

Donations and Grants can also be regarded as Gifts since you are not required to make any payments or returns.

Recording Gift Received in Simplebks: A Step-by-Step Guide

Step 1: Log in to your Simplebks account at www.simplebks.com.

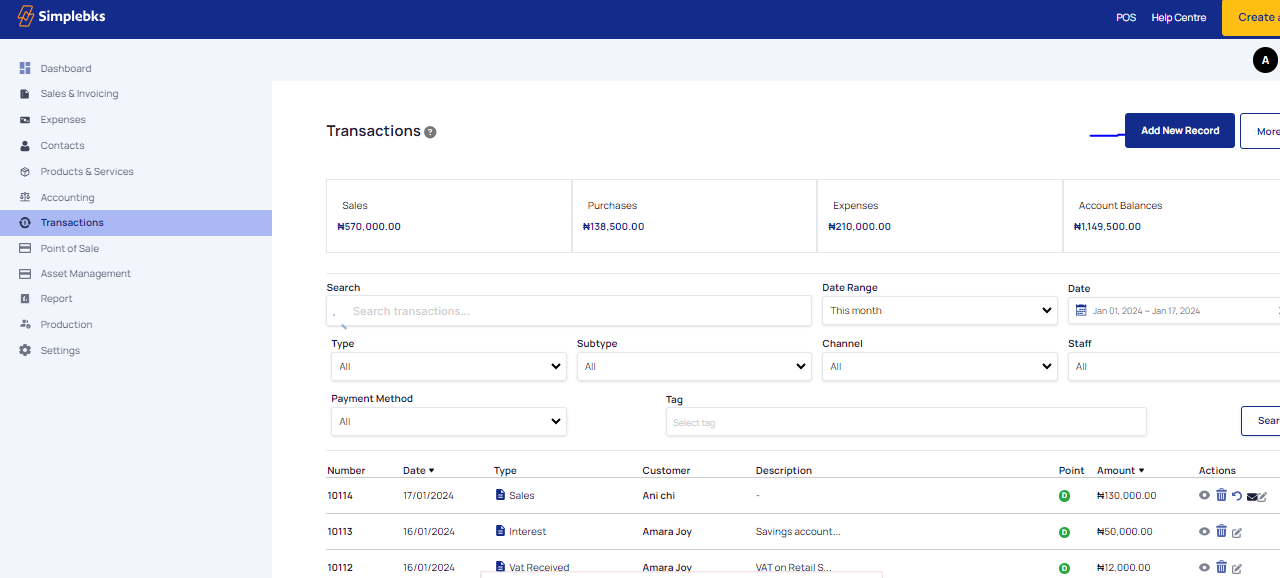

Step 2: Access the "Transactions" section on the sidebar and select "Add New Record."

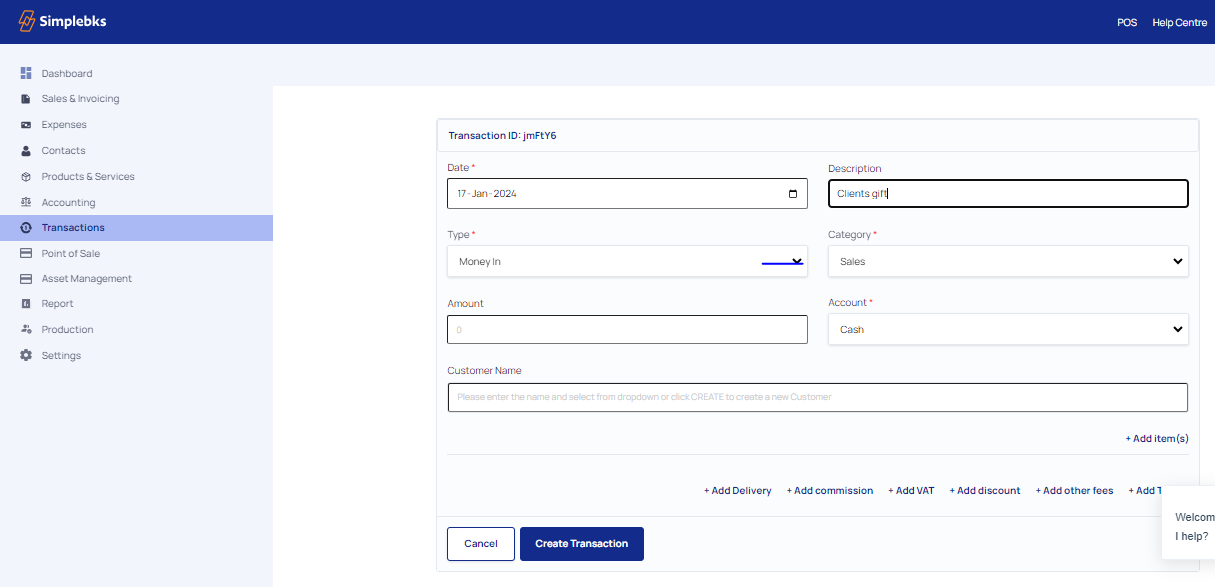

Step 3: Fill in the necessary details:

Transaction Date: Input the date of the gift received.

Description: Provide a brief description of the gift transaction.

Step 4: Specify transaction details:

Transaction Type: Choose "Money In" to indicate receiving funds.

Category: Select "Gift Received" to categorize the transaction appropriately.

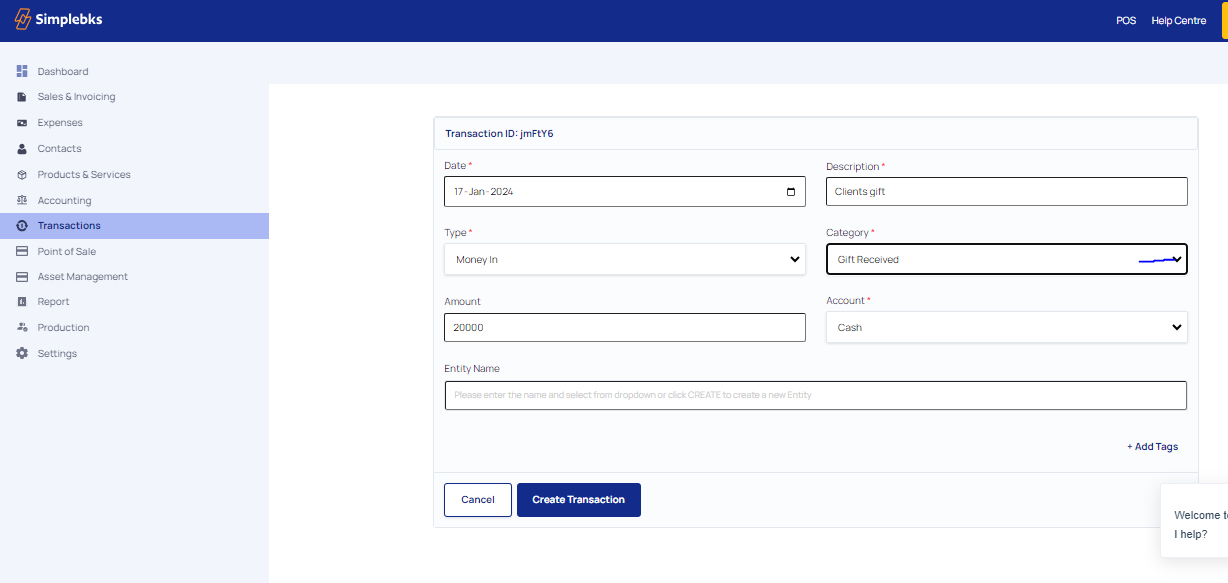

Step 5: Identify the source of the gift:

Enter the Account: Indicate whether the gift is received in cash (cash given out) or through a bank (mention the specific bank, e.g., Ecobank).

Step 6: Additional information:

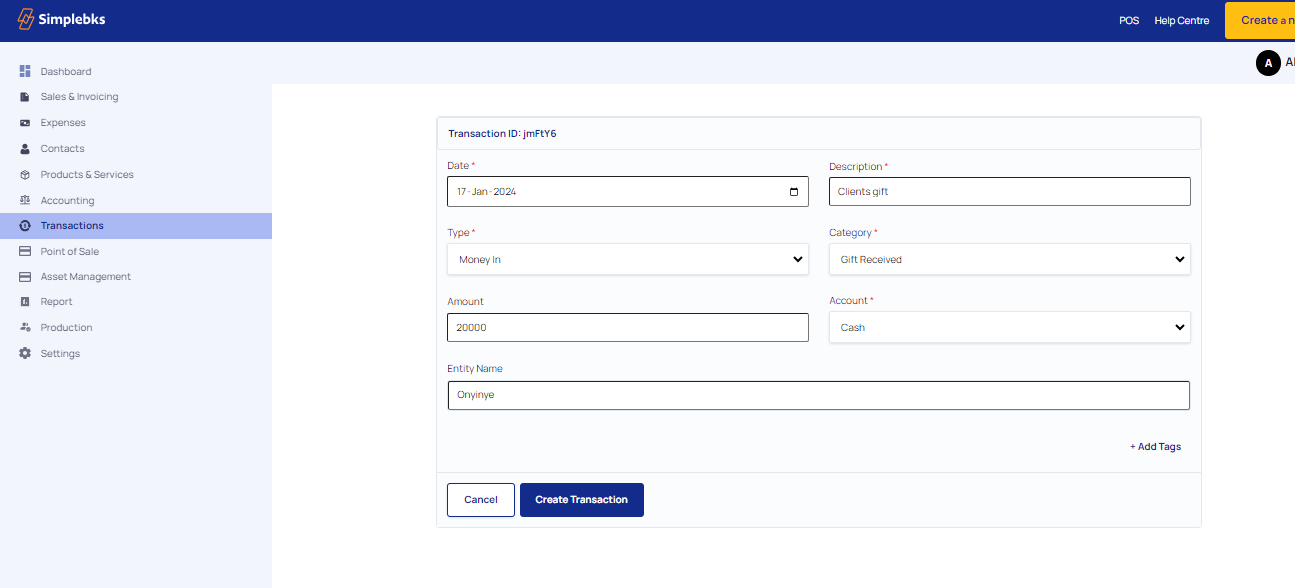

Enter the Entity Name: Specify the name associated with the gift.

Step 7: Confirm the transaction:

Click on "Create Transaction" to finalize the entry.

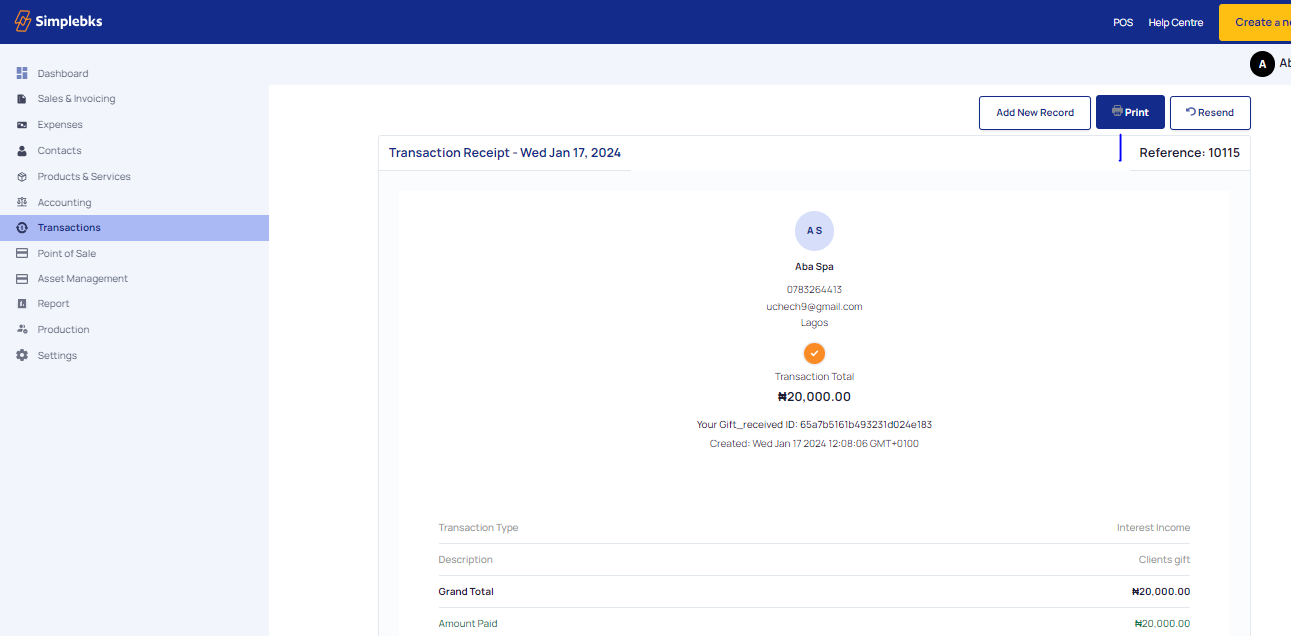

Step 8: Transaction success:

Receive confirmation that the transaction has been created successfully.

Step 9: Document the transaction:

Click on "Print" to obtain a physical copy or download the receipt as a PDF.

Was this article helpful?