How to Record VAT Received

updated 3 months ago

Value Added Tax (VAT) is a consumption tax levied on the sale of goods and services.

How to record VAT Received

Step 1: Access your Simplebks account by visiting www.simplebks.com.

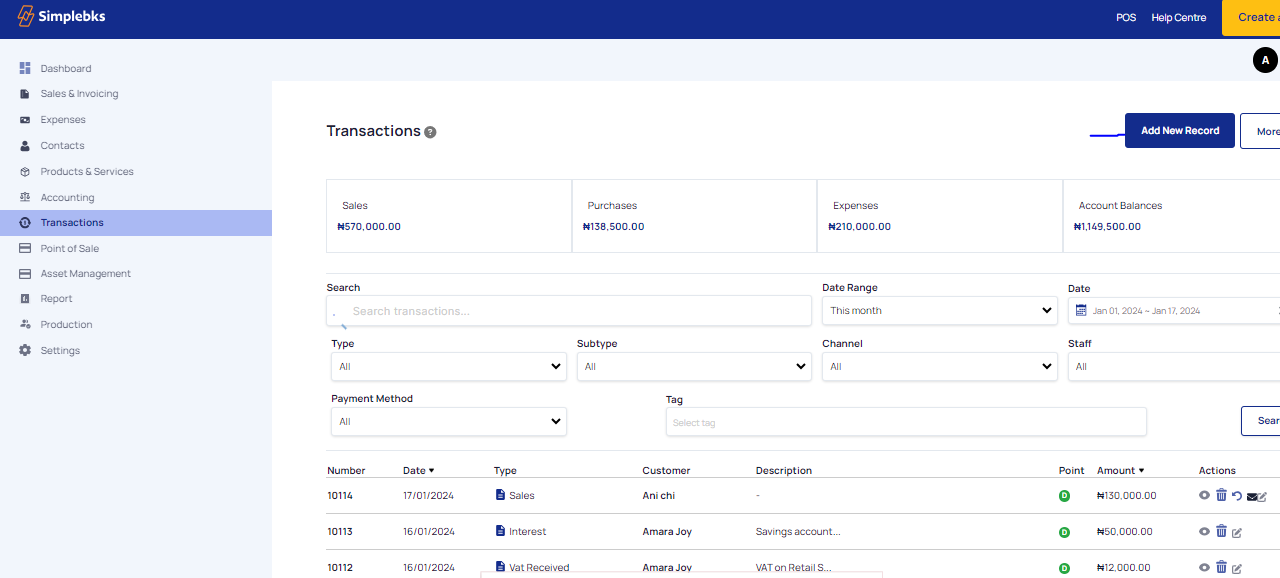

Step 2: Navigate to the "Transactions" section on the sidebar and select "Add New Records."

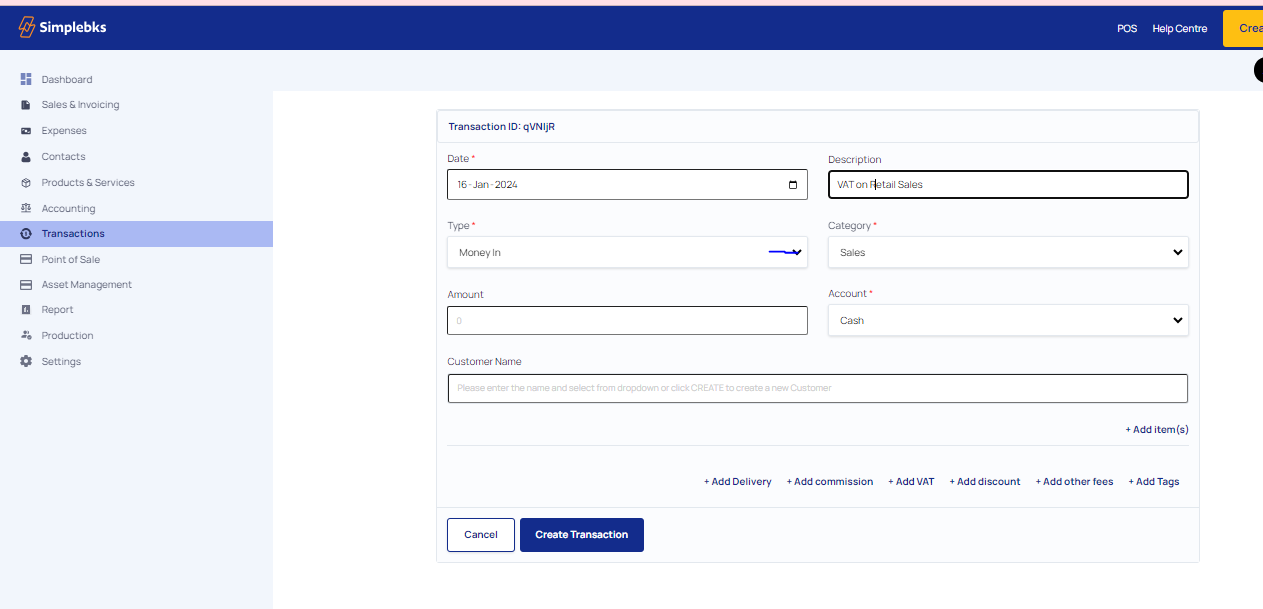

Step 3: Fill in the necessary details:

Transaction Date: Input the date of the transaction.

Description: Provide a brief description of the transaction.

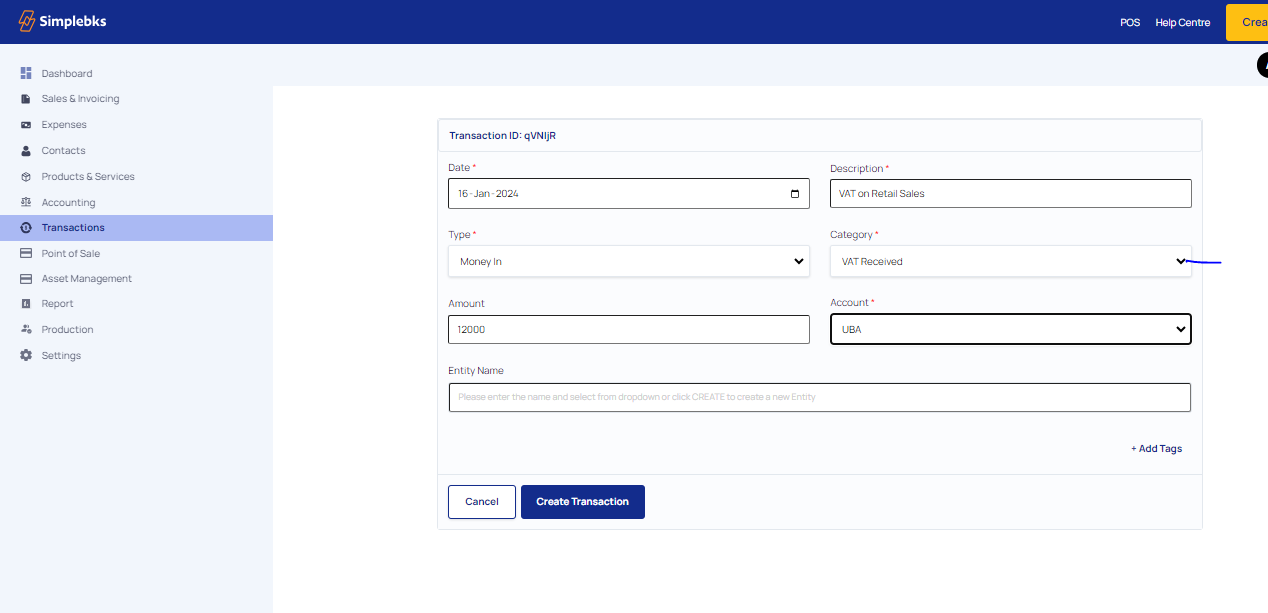

Step 4: Specify the transaction details:

Transaction Type: Choose "Money In" to indicate receiving funds.

Category: Select "VAT Received" to categorize the transaction appropriately.

Step 5: Identify the source of the funds:

Enter the Account: Indicate whether the funds are received in cash (cash given out) or through a bank (mention the specific bank, e.g., Ecobank).

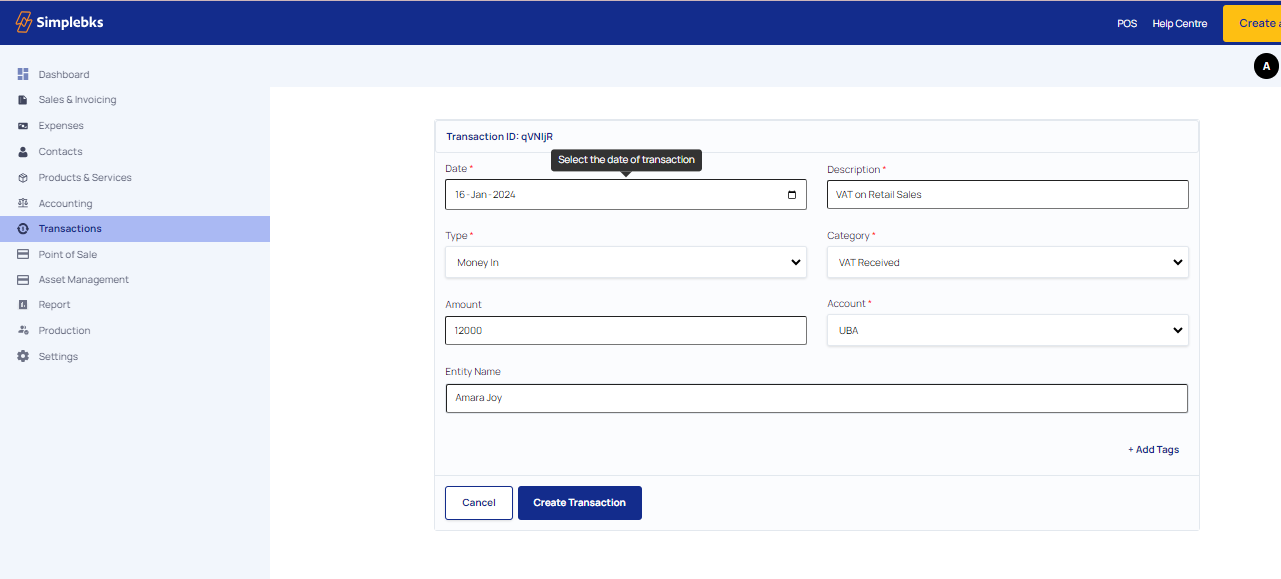

Step 6: Additional information:

Enter the Entity Name: Specify the name associated with the transaction.

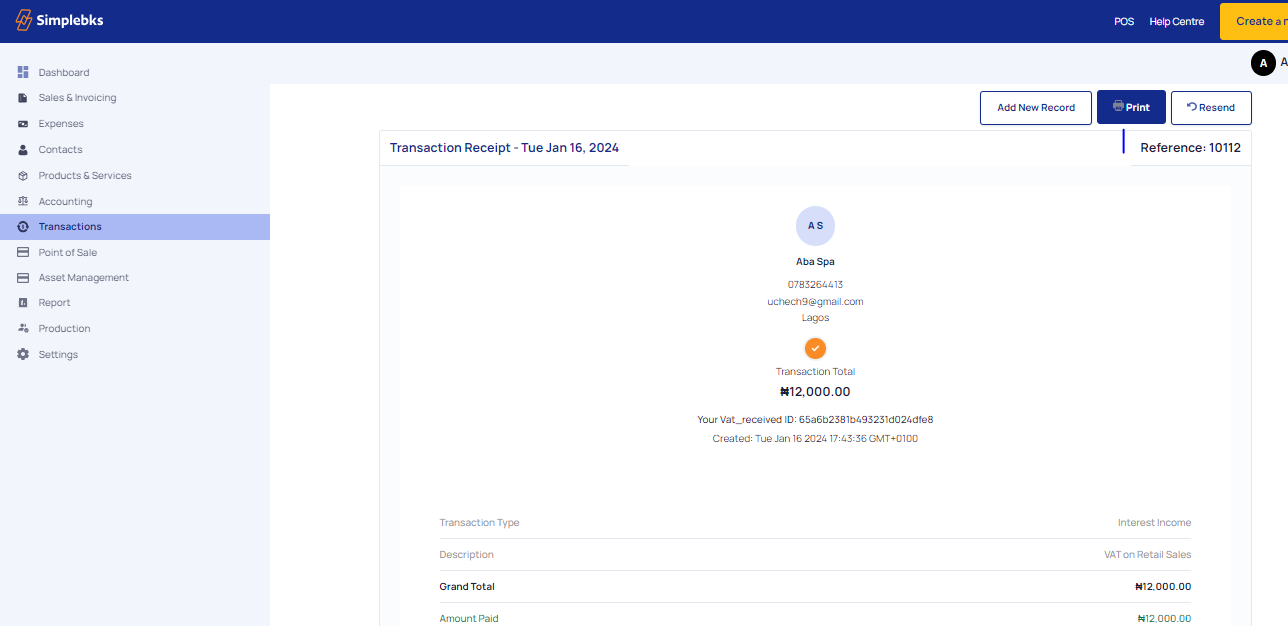

Step 7: Confirm the transaction:

Click on "Create Transaction" to finalize the entry.

Step 8: Transaction success:

Receive confirmation that the transaction has been created successfully.

Step 9: Document the transaction:

Click on "Print" to obtain a physical copy or download the receipt as a PDF.

By following these simple steps, you can accurately record VAT received in your Simplebks account.

Was this article helpful?